As a property owner in Bluffton, South Carolina, you may have been contemplating the idea of selling your home. With the real estate market continually evolving, understanding the current landscape and the options available to you can be crucial. This blog post will delve into why now is an excellent time to sell in Bluffton, the benefits of selling in today’s market, and how seller financing can empower you as a seller.

The Current Real Estate Landscape in Bluffton, SC

Market Trends: A Comprehensive Overview

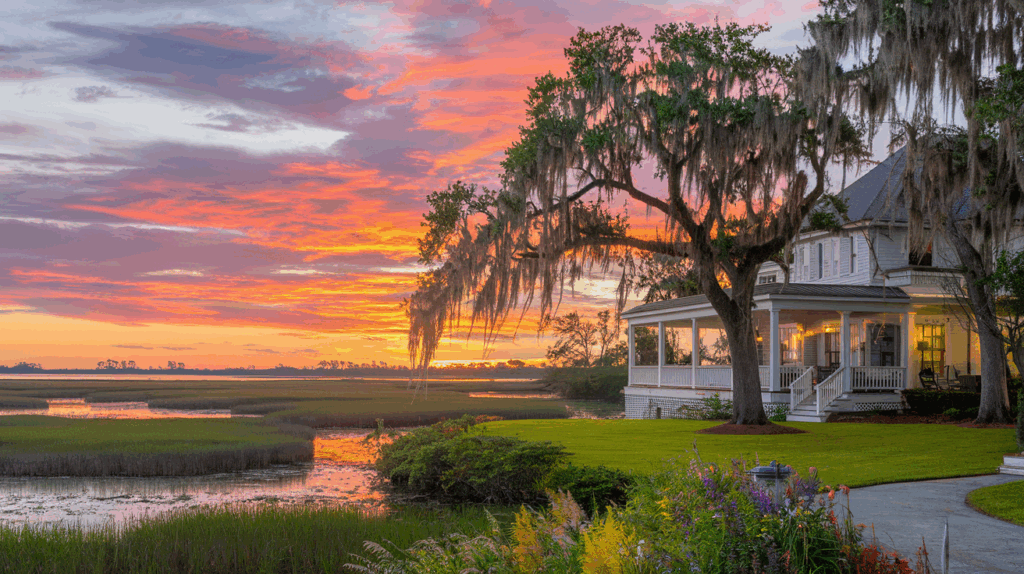

Bluffton, known for its charming Lowcountry atmosphere and close-knit community, has seen a significant surge in real estate activity in recent months. According to recent market analyses, the demand for homes in Bluffton has increased, driven by a combination of factors such as low interest rates, a growing population, and a shift toward remote work. This confluence of factors has created a seller’s market, where demand outstrips supply, allowing homeowners to maximize their returns.

The Benefits of Selling Now

- Increased Demand: Bluffton’s appeal as a picturesque town with easy access to Hilton Head Island and Savannah makes it a hotspot for buyers seeking a permanent residence or vacation home. The growing interest in the area means that your property is likely to attract multiple offers, potentially driving up the selling price.

- Low Inventory: The availability of homes for sale in Bluffton has dwindled, leading to increased competition among buyers. This scenario positions sellers favorably, allowing them to negotiate better terms and prices.

- Favorable Interest Rates: Although interest rates have fluctuated, they remain relatively low compared to historical standards. This allure for buyers can lead to quicker sales and higher offers, making it an opportune time for sellers.

- Rising Home Values: Home values in Bluffton have been steadily appreciating. If you’ve owned your property for several years, you may find that your investment has grown significantly, providing an opportunity to capitalize on your equity.

Empowering Your Sale: The Seller Financing Advantage

What is Seller Financing?

Seller financing is a creative financing option that allows sellers to act as the lender for the buyer. Rather than the buyer securing a mortgage through a traditional financial institution, the seller provides financing directly. This arrangement can provide numerous benefits to both parties and can make your property more attractive to a broader range of potential buyers.

The Benefits of Seller Financing for Sellers

- Expand Your Buyer Pool: By offering seller financing, you can attract buyers who may have difficulty securing traditional financing. This opens the door to a larger market of potential buyers, including first-time homeowners and those with less-than-perfect credit.

- Faster Sales Process: Traditional sales can be lengthy, especially when it comes to securing financing through banks. Seller financing can expedite the process, allowing you to close the sale more quickly.

- Higher Sale Price: Properties that offer seller financing may command a higher sale price since buyers are willing to pay more for the flexibility and ease of the transaction.

- Steady Income Stream: If you choose to finance the sale, you can receive monthly payments from the buyer, creating a steady income stream. This can be particularly advantageous for retirees or those looking to supplement their income.

- Tax Benefits: Depending on your tax situation, seller financing may offer certain tax advantages, such as spreading out capital gains over the term of the loan.

How to Structure Seller Financing

If you’re considering seller financing, it’s essential to structure the agreement thoughtfully. Here are key elements to consider:

- Down Payment: Determine an appropriate down payment that protects your investment while remaining attractive to buyers. Typically, a down payment of 10% to 20% is common.

- Interest Rate: Set a competitive interest rate that reflects the current market while providing you with a return on your investment.

- Loan Term: Decide on the length of the loan. Common terms range from 5 to 30 years, depending on what aligns with your financial goals.

- Payment Schedule: Outline a clear payment schedule, including due dates and accepted methods of payment.

- Legal Considerations: It’s vital to work with a real estate attorney to draft the necessary paperwork and ensure that the agreement complies with local laws.

Maximizing Your Returns: Practical Selling Tips

Preparing Your Home for Sale

- Curb Appeal Matters: First impressions count. Invest in landscaping, fresh paint, and minor repairs to enhance your home’s exterior appeal.

- Declutter and Stage: Create a welcoming environment by decluttering personal items and staging your home. A well-staged home can help buyers envision themselves living there.

- Highlight Unique Features: Bluffton’s homes often have unique characteristics. Make sure to highlight any special features such as outdoor spaces, historic architecture, or energy-efficient upgrades.

Pricing Your Home Competitively

Research comparable properties in your area, also known as “comps,” to determine a competitive listing price. Setting the right price from the beginning is crucial to attracting buyers while maximizing your returns.

Marketing Your Property

- Professional Photography: Invest in high-quality photography that captures your home’s best angles. Great visuals can make a significant difference in how your listing performs.

- Utilize Online Platforms: List your property on popular real estate websites, including Zillow and Realtor.com, and don’t forget to utilize social media for broader outreach.

- Engage a Real Estate Agent: Consider working with a knowledgeable local real estate agent who understands the Bluffton market. They can provide invaluable insights and assist in negotiations.

Negotiating Offers

When you receive offers, be prepared to negotiate. Understand your bottom line and be open to creative solutions, such as seller financing, to make your property more appealing.

The Role of Real Estate Experts

Why Choose Local Experts?

Navigating the real estate market can be complex, and having local expertise can make all the difference. Companies like Palmetto Land Buyers and Palmetto House Buyers can provide you with the insights, support, and resources you need to ensure a successful sale. They understand the intricacies of the Bluffton market and can guide you through the selling process with confidence.

Conclusion: Empowering Your Selling Journey

Selling your property in Bluffton, SC, can be an empowering experience, especially with the current market conditions. By understanding the benefits of seller financing and leveraging the unique characteristics of your home, you can maximize your returns and attract a wide array of buyers.

Now is the time to take action. Whether you choose to explore seller financing or traditional selling methods, equipping yourself with knowledge and resources will empower you to make the best decision for your future. Embrace the opportunities that lie ahead, and remember that with the right strategy, you can turn your Bluffton property into a successful sale.

If you’re ready to start your selling journey, consider reaching out to local experts at Palmetto Land Buyers and Palmetto House Buyers for personalized support and guidance. The path to a successful sale starts with informed decisions and proactive steps. Don’t wait—take the leap and explore the exciting possibilities that await you in Bluffton’s real estate market!

Related Links:

Owner Financing – Bluffton SC Real Estate – 4 Homes For Sale | Zillow – https://www.zillow.com/bluffton-sc/owner-financing_att/

Home | South Carolina Housing – https://schousing.sc.gov/

Owner Financing – Hilton Head Island SC Real Estate – 3 Homes For … – https://www.zillow.com/hilton-head-island-sc/owner-financing_att/

Community Development | Bluffton, SC – https://www.townofbluffton.sc.gov/201/Community-Development

Financial Options for Senior Living – The Pines at Bluffton – https://pinesbluffton.com/financial-options-for-senior-living/

James Teeple – Principal Owner – Teeple Development Group, LLC … – https://www.linkedin.com/in/james-teeple-109b83145

Coastal States Bank: Serving South Carolina, Georgia & Beyond – https://www.coastalstatesbank.com/

Jessica Tatro – Administrative Assistant – Terra Excavating, LLC … – https://www.linkedin.com/in/jessica-tatro

Programs for Homebuyers | South Carolina Housing – https://www.schousing.sc.gov/homebuyers/programs-homebuyers

Commercial Real Estate Loans | Coastal States Bank – https://www.coastalstatesbank.com/small-business/small-business-lending/commercial-real-estate